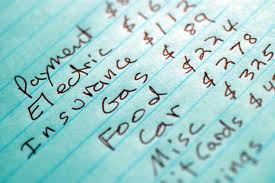

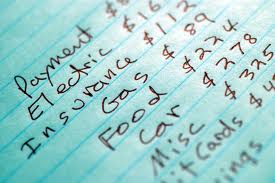

When I first started out budgeting, I started budgeting my money on a monthly basis. My mom sat down with me after high school when I was planning on moving out, and helped me construct a budget based on my monthly income. I think this is the way that she always did it, so it never occurred to me to instead budget on a bi-weekly basis, or that any other time period for budgeting would work.

Many people budget on a monthly basis, but then some also budget on a biweekly basis. Here are some pros and cons of each method to help you decide what would work best for you:

Monthly Budgeting

Budgeting monthly is by far the most common practice. This is common because:

- Bills, payments, and other expenses are usually issued monthly

- Bank statements are usually released once per month

- Commission cheques and other ‘bonuses” are usually issued monthly for those who have a fluid compensation structure

- Debt payments are usually due on a monthly basis

Because of these norms, people tend to add up their income and budget on a monthly basis. It can be a lot easier and requires far less math and exceptions than some of the other methods.

Bi-Weekly Budgeting

I started budgeting on a bi-weekly basis as well as a monthly basis because I am paid bi-weekly. This way I know which part of each cheque needs to go where. Here are some advantages:

- Most people are paid on a bi-weekly basis

- The time period is shorter and therefore allows for easier adjustments as needed

- You are less likely to forget about cash output when tracking your spending and comparing to your budget at the end of the period

Some disadvantages exist for bi-weekly budgeting as well:

- Since bills, payments and other financial responsibilities tend to come out monthly, you may have to either split them or do some fancy math, otherwise your budget will be unbalanced

- You may have to rely on memory when tracking spending at the end of the two weeks because bank statements, if you rely on them, come out monthly

Quarterly Budgeting

Some people also budget quarterly. This may work best for you if you have an irregular income, because that way you can average it over three months instead of change your budget each month depending on what comes in.

This may make your budget inaccurate, however, because over a period of months many costs can fluctuate drastically (ie gas prices, bills).

Yearly Budgeting

I’ve yet to come across somebody that budgets on a yearly basis, but one large disadvantage of doing so would be that yearly budgeting would make it very difficult to anticipate changes to your budget, or changes in priorities.

Do you budget on a monthly basis like me, or take a different approach?

I budget on a monthly basis. That makes it easier for me to save up for big annual expenses like car repairs or infrequent expenses such as gifts.

It may be difficult at a personal level to do an annual budget but that’s the way business often works and indeed reports accounts. Of course if you are assured cashflow it should be OK. Weekly budgets and reports are too frequent – you may do a monthly shop in the wholesalers and then have to divide it up. I guess monthly is probably OK but in the end it depends on the frequency of your expected regular income.

I do monthly budgets as well; it is the easiest for me because, like you said, so many things are due on a monthly basis. But I think it would be neat to keep my budgets for a year and start tracking annual costs, just to see how things add up.

We budget on a monthly basis but input our expenses in daily. It has been a worthwhile practice for us because without the budget we likely wouldn’t be where we are today, debt free.

I budget monthly but only make changes & adjustments to my budget yearly after reviewing 12 months worth of my spending

For a lot of people, it depends on how often they get paid. I was always bi-monthly and now I am monthly. At one point, I was weekly!

How was budgeting on a weekly basis like? I’d like to try doing that.

I have been budgeting on a monthly basis since I started working and it’s working for me really well.