Today we have a guest post from a fellow blogger, Graham from Money Stepper.

People often cite the cost of eating well as being the reason they don’t do it. “A salad box from Pret-a-Manger costs £5.00 or I can get a sandwich and sausage roll for £2.00 from Greggs”. This is something I just don’t buy into (forgive the pun).

What is more expensive?

I would say the scale looks something like this:

HEALTHY FOODS < UNHEALTHY FOODS < “HEALTH” FOODS

There is a clear difference between healthy and health foods.

- Healthy foods are those which you can purchase at a reasonable price which are healthy (fresh fruit, fresh vegetables, nuts, healthy meats etc).

- “Health foods”, on the other hand, are those which are created by the industry at a premium price which are advertised as being “healthy” (think about innocent smoothies, packaged salads, fancy dried fruit & nuts).

I’m willing to accept that health foods are more expensive that cheap, unhealthy food. However, I am sure that healthy foods are cheaper than unhealthy alternatives.

This is for two main reasons:

- When you eat healthy foods, you tend to eat less

- When you eat healthy foods, you tend to make these yourself from scratch than buying products from shops, takeaways, cafes and restaurants

Real life examples

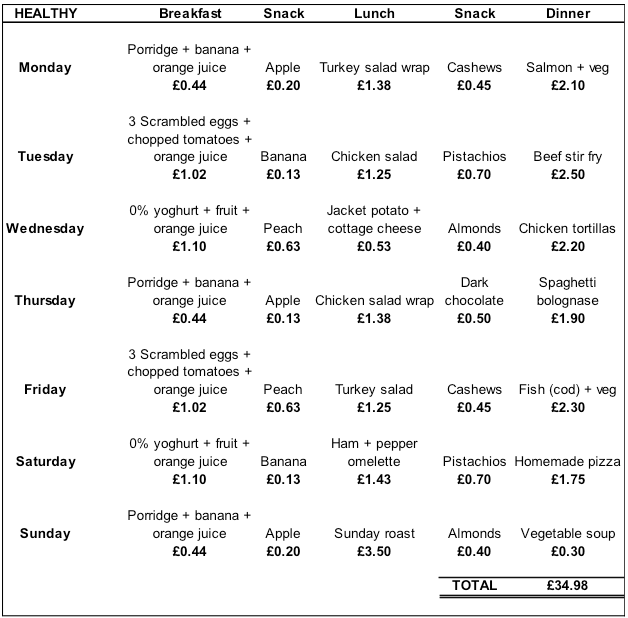

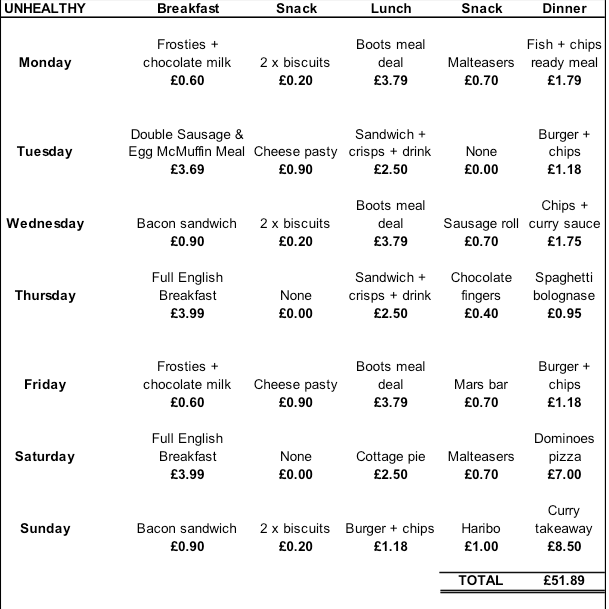

To prove this point, I have included two sample weeks below. The first is eating well, where all foods are bought from supermarkets and prepared yourself at home. The second is eating poorly, which includes a mix of buying food from high street stores, fast food outlets, takeaway deliveries, etc etc.

From this example, the cost of eating healthily is 33% cheaper than eating poorly.

You can see that the main contributors of this are the expensive takeaways and lunches purchased from shops.

Cause vs effect

When it comes to budgeting and eating well, it should be your diet which comes first. If you focus on what you eat and ensure that you have each meal planned during the week, the savings will come.

When considering the example provided earlier, we made the comparison of a prepared salad from a high street store for £5 and the Greggs sandwich and sausage roll for £2.00.

However, this isn’t the true comparison.

The sandwich and sausage roll for £2 should be compared to the chicken salad wrap prepared from scratch at home. This more fair comparison has the healthy option at £1.38, a significant percentage less than the sandwich and sausage roll.

The trick is to plan

Planning => Eating healthy => Saving

Not planning => Eating unhealthily => Spending a little more

OR

Not planning => Eating “health” foods => Spending lots more

Without planning, there is no way you can be both healthy and wealthy!