The world of work is a fascinating time capsule, reflecting the ever-evolving relationship between humans and technology. Jobs that were once considered the backbone of society can vanish in the blink of a historical eye, replaced by automation, economic shifts, or cultural changes. While these advancements often lead to progress and efficiency, they also leave behind a sense of nostalgia for simpler times and a reminder of the irreplaceable human element in certain tasks.

Travel Agent (Pre-Internet Boom)

These travel specialists once meticulously planned itineraries, booked flights and hotels, and offered personalized recommendations. The rise of online travel agencies and booking platforms in the late 20th century significantly reduced the demand for their services.

Film Developer (Pre-Digital Photography)

From capturing memories to professional photography, film developers are skilled technicians who can process film into photographs. However, the widespread adoption of digital cameras in the early 2000s rendered film photography and its supporting jobs obsolete.

Switchboard Operator (Pre-1960s)

Before automated systems and direct dialing, these human “information highways” connected callers by physically plugging jacks into specific lines. With the rise of electronic switching in the 1960s, this labor-intensive role became obsolete.

Elevator Operator (Pre-1970s)

These courteous individuals once controlled the ascent and descent of elevators, ensuring passenger safety and providing a personalized touch. Automatic elevators, driven by technological advancements, phased out this role by the 1970s.

Milkman (Pre-1980s)

A familiar sight in neighborhoods for decades, the milkman delivered fresh dairy products straight to customers’ doorsteps. The rise of supermarkets with refrigerated sections and changing consumer habits led to the decline of home milk delivery by the 1980s.

Town Crier (Pre-Mass Media)

In a time before newspapers and radio broadcasts, town criers disseminated news and announcements by word of mouth, often ringing a bell to gather attention. The development of mass media in the 19th and 20th centuries made this role a thing of the past. (Source: English Heritage [invalid URL removed])

Tollbooth Collector (Rise of Electronic Tolling)

Tollbooth collectors were responsible for collecting fees from motorists on highways and bridges. The implementation of electronic toll collection systems, utilizing transponders and automated scanners, has significantly reduced the need for these positions.

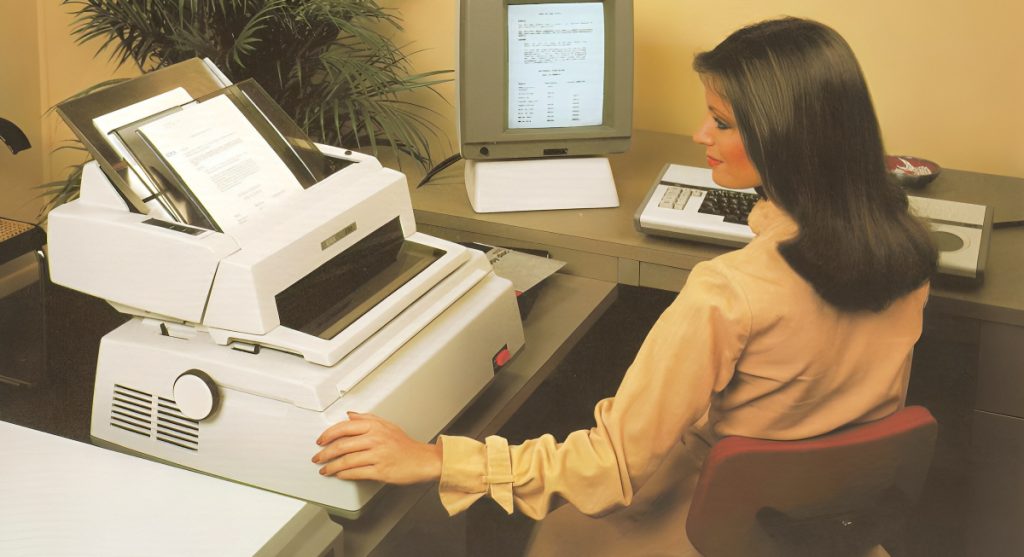

Typesetter (Pre-Desktop Publishing)

These skilled professionals can meticulously arrange and set type for printing presses. The invention of desktop publishing software in the 1980s revolutionized the printing industry, making typesetting a relic of the past.

Video Rental Store Clerk (Rise of Streaming Services)

Once a popular weekend destination, video rental stores offered a curated selection of movies for rent. The rise of streaming services and on-demand video content in the 21st century has rendered these stores largely obsolete.

Factory Assembly Line Worker (Automation and Globalization)

Once plentiful manufacturing jobs have been impacted by automation and globalization. Robots and computer-controlled machines have replaced many assembly line workers, while production has shifted to countries with lower labor costs.

Ice Cutter (Pre-1900s)

Imagine a world before refrigerators! Ice cutters harvested massive blocks of ice from frozen lakes and rivers during the winter, storing them in ice houses to provide cooling throughout the warmer months. The invention of mechanical refrigeration in the late 19th century rendered this backbreaking labor obsolete.

Pinsetter (Pre-Automatic Bowling Machines)

Bowling alleys were once a lively scene with human pinsetters resetting pins after each frame. This physically demanding job required agility and coordination to reset pins for enthusiastic bowlers efficiently. Automatic pinsetting machines, introduced in the mid-20th century, revolutionized the sport and eliminated the need for human pinsetters.

Telephone Operator (Pre-Automatic Switching)

Before the convenience of direct dialing, telephone operators played a crucial role in connecting callers. Using switchboards with blinking lights and complex wiring, they manually established connections, often becoming familiar voices to frequent callers. Automatic switching technology phased out this role by the mid-20th century.

Cobblestone Layer (Pre-Asphalt and Concrete)

Cobblestone streets were once a common sight in cities around the world. Skilled cobblestone layers meticulously hand-laid these stones to create durable and attractive roadways. The invention of asphalt and concrete in the late 19th and early 20th centuries offered a faster and more cost-effective alternative, leading to the decline of cobblestone laying as a profession.