It seems there is an app for everything these days, especially for saving money. One in particular, called Paribus, will get you a refund when something you purchased was found cheaper. The goal is to help you gain money when prices change or drop. But, does it really work? Is Paribus worth it? I decided to do a Paribus review to find out.

My Paribus Review

Paribus was created and developed by two Harvard graduates, Eric Glyman and Karim Atiyeh, who used to use their skills to help Fortune 500 companies, according to their website. They now use their talents and knowledge in technology and business to help the everyday consumer, like you, save money.

Many retailers promise a price match credit when the cost of an item drops after you’ve purchased it. The problem is that they won’t just offer it to you; you have to work for it. So, Paribus does the work for you. They find these reductions and trace them back to your purchases when you sign up, helping you score some savings where you did not think they existed. The app works to find these price changes on a variety of merchandise, from clothes to groceries. Impressive, no?

How Paribus Works

Eric and Karim developed algorithms that search for changes in prices from a variety of retailers, known as their supported merchants. The app works day in and day out monitoring opportunities to get you some cash back from your purchases using information from your receipts. They are the ones contacting the stores to earn you money. Thus, all you need to do is go about your normal day and wait for the money to roll back in.

Of course, there are terms and conditions to this, so make sure you review those before signing up.

What You Need to Know

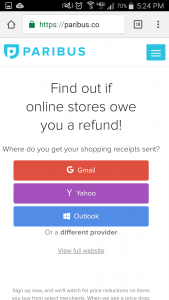

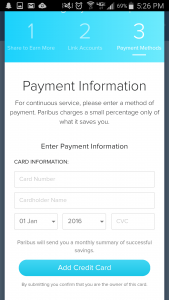

To sign up, you simply choose the email provider for which you have or will have shopping receipts sent to. If you currently do not link your email to online shopping accounts, you will want to in order for this app to work. You’ll also need to attach a credit or debit card that you use for purchases so that they can pay you. In addition, you have the option to also link your Amazon account for tracking. It’s important to keep in mind, though, that Paribus only works with certain stores.

Some people may not feel comfortable giving access to email and credit card information to an app, but Paribus assures users through the press kit that their systems are secure with an SSL bank-grade encryption.

“Security is embedded through our entire architecture, including dedicated firewalls, VPN services, intrusion prevention systems and stringent access controls,” the release states.

Atiyeh also reminds its potential users that retailers actually use our data against us to get consumers to pay more. When you realize this, it really isn’t a big deal to give access to your email and payment to Paribus for the purpose of getting money back, especially knowing their systems are secure.

Luckily, you don’t have to decide right away; you can opt to enter your card information in later like I did. This can allow time to do some more research before deciding whether or not you want to actually give your card number. Another option for your security relief worries would be to create a separate email that is dedicated only for shopping online. The one I used for my Paribus subscription is set up this way, and they only have access to one email of your choosing.

Lastly, the app is currently available only to residents 18 and older in the U.S. and Puerto Rico. You must subscribe with a valid email address and be enrolled in the Paribus service or app. Unfortunately, they do reserve the right to cancel your account at any time or refuse access to the service, according to their Terms of Service.

Is It Legit?

I have not had the app long enough myself to see if it actually works. Plus, it takes 48 hours before your purchases from the last three months or 90 days appear in the app. However, there appears to be a lot of positive feedback thus far from people who have actually seen it work.

In a testimonial from Catherine Geewax, a Paribus member since 2014, she said that within 12 hours, she received a refund of $70 following a shopping spree to Nordstrom.

Omar, another member, woke up to find $80 in his account after buying two monitors the week before that were reduced in price.

Even though these numbers are not always the case, every little bit helps. You’re still getting money back that you would not have had (without spending the time and energy yourself to retrieve) for purchases you were going to buy anyway.

“At our current rate, we’re saving people on 1/4 of their orders, almost 10% per purchase — automatically,” Glyman said in the press kit.

Conclusion

Ten percent per purchase may not seem like a lot, but at least it is something. Just think about the benefits of using this service during the holidays. I know I plan to, which will definitely come in handy to save a little extra on Christmas shopping.

Hopefully, my Paribus review helped you see if this service is right for you. Make sure to check back in to see how it continues to work for me. Finally, if you’d like to sign up for Paribus, please feel free to use this link, it will help keep the lights on for this website.

Do you use Paribus? What are your thoughts on the app? I would love to hear your opinion in the comments below.

This post was sponsored by Paribus.

Jenn Clark is a writer, PR specialist, entrepreneur, blogger and coffee enthusiast. A lover of laughter, traveling and cheese, she’s written about her life experiences here at suburbanfinance while at the same time growing other young professionals. You can find more of her work at Jennblogs.co.