It might surprise you to learn that it is possible to actually to move funds from a credit card to your bank. Different companies permit this in different ways, though, and it typically does not come without some extra fees and interest rates. However, there may be times when doing so is necessary. For today’s article, I decided to find out how to transfer money from a credit card to a bank account.

Where to start

First, you’ll want to see if your credit card holder permits this type of transaction. Some actually do, but not without fees. Not to mention, your bank may also have its own transferring charges.

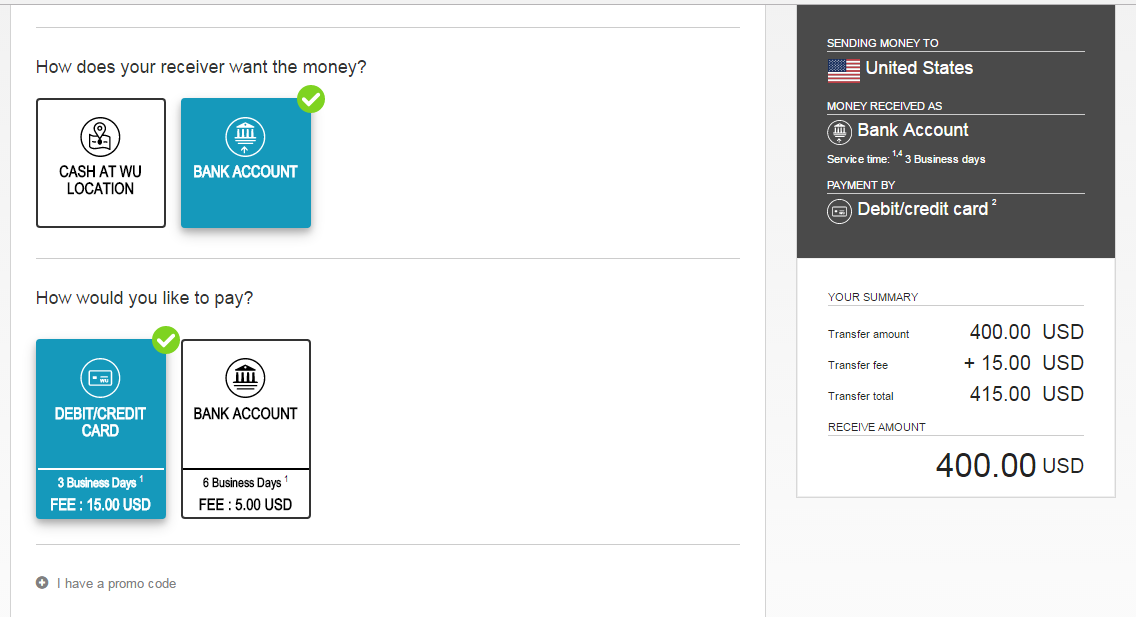

For instance, Western Union allows you to fulfill such a transaction by logging into your WU account. When you’ve entered the amount you wish to move along with the account information, you will receive an email confirmation of the act. The cost to transfer from your Western Union card is $15 and will take three days to complete.

Again, this does not include any additional charges from your bank. A company like Western Union appears to provide periodic promotional codes to offset this cost. Make sure to still read all the terms and conditions prior to completing the transaction, which may look similar to Western Union’s.

How to transfer money from a credit card to a bank account (alternatives)

If your credit card company does not offer money transfers directly to your bank or if the fees are too high to deem worthy of doing, there are other options, such as the following:

- Cash Advance. A cash advance may be requested that could then be deposited into your bank account. If your credit card provider offers cash advances to its users they do typically also allow cash transfers. However, the interest rates and charges may prove to be more expensive than other routes.

- ATM Withdrawal. Another option for you may be to directly take out cash from your card through an ATM then deposit the money into your desired account. Take notice, though, the interest rates on such a transaction may still be much higher if not the same, depending on your terms and conditions, so proceed with caution.

- Checks from the Credit Card Company. In a Quora forum, a few individuals in the finance industry mentioned using checks from the credit card company, which allows you to take money out from your credit line and use it as a form of payment. This form of payment does include a bank deposit. Some companies have equally high fees for usage of these checks, others may actually make it so you save money by doing so. So, it all depends on who you use for your credit.

- Loan from the Credit Card Company. In the same forum, retrieving a loan from the credit card issuer was also described as an option. The money may be put directly into your account or you may be issued checks. You would then pay this money back monthly as you normally would. This alternative seems as though it should only be considered if you are needing a larger amount of funds and are capable of repaying monthly. Remember, interest rates from credit card companies tend to be higher than most.

- Personal Line of Credit. Bryan Hanley, a self-described financier, said in the responses of the forum that a personal line of credit would be, in his opinion, the best option as it allows you to convert credit to cash. A personal line of credit is essentially a loan used as a credit card. See an example of how one works through Wells Fargo’s service.

- MoneyGram. I found MoneyGram online during my research. They are a money transfer and payment services company that makes it easy to send money to a bank account. Unfortunately, there may be limitations with MoneyGram, such as not being compatible with certain banks. But, you can send money globally through them, which is a plus. Additionally, you could sign up for money transfer credit cards instead, which you can learn more about here.

Keep in Mind

Your bank may limit the amount you are able to transfer at a time. You may also only have a certain amount you can take out of your card balance each month as well. This is another factor you will want to inquire about prior to moving forward with the transaction. It is also important to mention that each company may have different fees for different options to transfer money. Plus, regardless if you take cash out from your card or transfer money, remember that it is still borrowed money. Therefore, interest rates may still apply in addition to the transfer fees. You’ll still want to make sure you are paying off your monthly card balance to maintain your credit score.

Finding out how to transfer money from a credit card to a bank account can be tedious, but I recommend starting out with a simple call to a representative from your card’s company. Don’t be afraid to ask as many questions as necessary like what to expect in fees and special terms that may apply.

Have you ever transferred money from your credit card to a bank account? How did it work out for you?

Jenn Clark is a writer, PR specialist, entrepreneur, blogger and coffee enthusiast. A lover of laughter, traveling and cheese, she’s written about her life experiences here at suburbanfinance while at the same time growing other young professionals. You can find more of her work at Jennblogs.co.